Coso Internal Control Integrated Framework 2013 Free Download

- Coso Internal Control Integrated Framework 2013 Free Download For Pc

- Coso Internal Control Framework Example

Issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), the 2013 Internal Control – Integrated Framework(Framework) is expected to help organizations design and implement internal control in light of many changes in business and operating environments since the issuance of the original Framework in 1992.The new Framework retains the core definition of internal. Framework COSO’s Internal Control–Integrated Framework (1992 Edition) Refresh Objectives Updated Framework COSO’s Internal Control–Integrated Framework (2013 Edition) Broadens Application Clarifies Requirements Articulate principles to facilitate effective internal control Why update what works – The Framework has become the.

COSO releases new Enterprise Risk Management Framework (2017), updating the 2004 ERM framework In September 2017, COSO released its highly anticipated ERM Framework entitled Enterprise Risk Management–Integrating with Strategy and Performance. This new document builds on its predecessor, Enterprise Risk Management–Integrated Framework (originally published in 2004), one of the most widely recognized and applied risk management frameworks in the world.

The updated document outlines how executives can have greater confidence in addressing many critical 21st century business challenge as they navigate evolving markets, rapid innovation and heightened regulatory focus. The Framework, authored by PwC under the direction of the COSO Board, is designed to turn a preventative, process-based risk monologue into a proactive, opportunities-focused conversation to uncover how risk management can create, preserve, and realise quality and value. COSO releases new Enterprise Risk Management framework (2017), updating the 2004 ERM framework In September 2017, the Committee of Sponsoring Organizations of the Treadway Commission (COSO) released its highly anticipated ERM Framework: Enterprise Risk Management–Integrating with Strategy and Performance. This new document builds on its predecessor, Enterprise Risk Management–Integrated Framework (originally published in 2004), one of the most widely recognized and applied risk management frameworks in the world. In 2014, COSO engaged PwC as the principal author of the update which is designed to help organizations create, preserve, and realize value while improving their approach to managing risk.The update highlights the importance of enterprise risk management in strategic planning.

Altium designer 10 standalone license crack. It also emphasizes embedding ERM throughout an organization, as risk influences strategy and performance throughout the organization. In keeping with its overall mission, the COSO Board commissioned and published in 2004 Enterprise Risk Management—Integrated Framework.

Since that time, the publication gained broad acceptance by organizations in their efforts to manage risk. However, also through that period, the complexity of risk changed, new risks emerged, and both boards and executives have enhanced their awareness and oversight of enterprise risk management while asking for improved risk reporting. COSO's 2017 update to the 2004 ERM framework addresses the evolution of enterprise risk management and the need for organizations to improve their approach to managing risk to meet the demands of an evolving business environment. The updated document, now titled Enterprise Risk Management—Integrating with Strategy and Performance, highlights the importance of considering risk in both the strategy-setting process and in driving performance. The first part of the updated publication offers a perspective on current and evolving concepts and applications of enterprise risk management. The second part, the Framework, is organized into five easy-to-understand components that accommodate different viewpoints and operating structures, and enhance strategies and decision-making. In short, this update:.

Provides greater insight into the value of enterprise risk management when setting and carrying out strategy. Enhances alignment between performance and enterprise risk management to improve the setting of performance targets and understanding the impact of risk on performance. Accommodates expectations for governance and oversight. Recognizes the globalization of markets and operations and the need to apply a common, albeit tailored, approach across geographies.

Presents new ways to view risk to setting and achieving objectives in the context of greater business complexity. Expands reporting to address expectations for greater stakeholder transparency. Accommodates evolving technologies and the proliferation of data and analytics in supporting decision-making. Sets out core definitions, components, and principles for all levels of management involved in designing, implementing, and conducting enterprise risk management practices. The Committee of Sponsoring Organizations of the Treadway Commission (COSO) released the updated Internal Control–Integrated Framework (2013 Framework) in May 2013.

COSO announced that the 2013 Framework will supersede the original 1992 Framework at the end of the transition period (December 15, 2014). The SEC commented that the Staff plans to monitor the transition for issuers using the 1992 Framework to evaluate whether and if any Staff or Commission actions become necessary or appropriate in the future. The Staff more recently commented that the longer issuers continue to use the 1992 Framework, the more likely they are to receive questions from the Staff about whether the issuer’s use of the 1992 Framework satisfies the SEC's requirement to use a suitable, recognized framework, particularly after December 15, 2014 when COSO will consider the 1992 Framework to have been superseded. COSO’s primary objectives for updating the Internal Control—Integrated Framework included (i) clarifying requirements for effective internal control, (ii) addressing changes in business (e.g., globalization, use and dependence on technology, complexity) that introduce or elevate risk of achieving entity objectives, and (iii) encouraging users to apply internal control to additional entity objectives (such as regulatory reporting, operations and compliance).

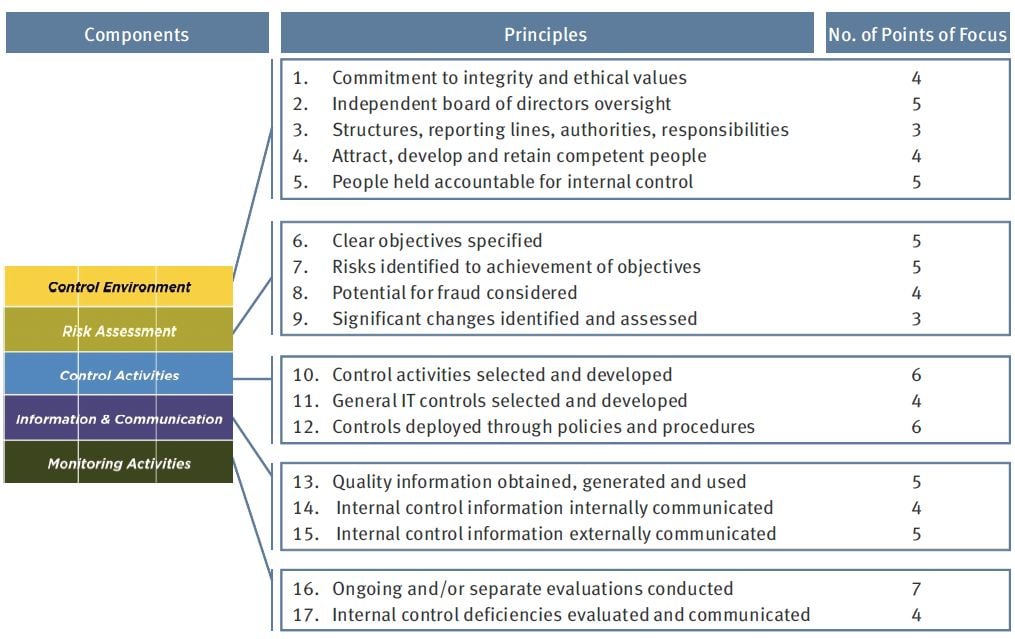

The 2013 Framework describes two additional requirements (in italics) for an effective system of internal control: - Each of the five components of internal control and relevant principles is present and functioning - The five components of internal control operate together in an integrated manner. The seventeen principles set out in the 2013 Framework are fundamental concepts associated with the five components of internal control. These concepts were implicit in the 1992 Framework. The 2013 Framework explicitly requires that each relevant principle be present and functioning (i.e.

Designed and operating effectively) to demonstrate that all five components of internal control are present and functioning. The Firm has developed templates and guidance to help clients assess and document how the company’s ICFR satisfies the seventeen principles. We do not believe the additional criteria fundamentally change what is required for an effective system of internal control over financial reporting. However, as management and internal auditors assess the design and operating effectiveness of the company’s ICFR in accordance with the 2013 Framework, they may identify internal control deficiencies that require remediation during 2014.

And why it deserves attention from public and privately held companies While internal controls can never be failsafe or provide absolute assurance, they are still the best defense and protective measure against fraud that an organization can put into place. And although private organizations may not have the same level of requirements as public registrants related to internal controls, they should still pay attention to the Committee of Sponsoring Organizations (COSO) of the Treadway Commission’s new framework released in May. The original COSO Internal Control – Integrated Framework (1992) has been the leading framework for designing, implementing and conducting internal control and assessing the effectiveness of internal control. The COSO framework has been used broadly with both private and public organizations and it was accepted by the SEC as a framework for attesting to internal control over financial reporting as required by the Sarbanes-Oxley Act of 2002 (SOX). But in the last twenty years, much has changed – business and operating environments have become increasingly complex, technologically driven and global.

Additionally, stakeholders are more engaged than ever, demanding transparency and accountability. In May, COSO released their new integrated framework to appropriately reflect the changes that have occurred in the last two decades. And although the new framework is an improvement, the 1992 version will remain appropriate and relevant for a transition period that will end December 15, 2014. Why is this important for private companies?

Internal controls not only reduce the risk of loss, but help ensure that information is complete and accurate, financial statements are reliable and that an entity complies with laws and regulations. Public registrants have more stringent requirements related to internal controls and essentially must pay attention to the COSO framework. But fraud and risk of loss is not exclusive to large, public companies. According to the ACFE’s Report to the Nations on Occupational Fraud and Abuse (2012 Global Fraud Study), “the typical organization loses 5 percent of its revenue to fraud each year.” and “Occupational fraud is a significant threat to small business.” In fact, they report the smallest organizations suffered the largest median losses. With fewer resources, the losses experienced by small businesses tend to have a greater impact than they would in larger organizations.

And smaller organizations typically employ fewer and less effective anti-fraud controls than their larger counterparts, which increases their vulnerability. Keeping up with this ever-changing environment is one of the best ways to protect an organization. As such, internal controls should be a process of continuous improvement by organizations large and small. Implementing and layering in the new framework is an excellent opportunity to improve a functioning system or fix a broken or insufficient system of internal controls.

Further, while COSO is not a standard setter and does not have the power to require an organization to switch to the new framework, organizations might have some difficulty explaining to their stakeholders why they are not using the new framework. Why the framework had to change Competitive pressures, advances in technology and regulatory scrutiny have contributed to increasing expectations for providing relevant information immediately.

Coso Internal Control Integrated Framework 2013 Free Download For Pc

Coso Internal Control Framework Example

Additionally, investors, owners, regulators and other users continue to demand more and quality reporting.